We help you track your expenses.

Every single penny of it, no kidding!

Emma wants to share her story with you

Hi Emma here,

I am not writing this to tell you how awesome this tool is you can probably find it for yourself. But something more important. Something that really touched me and I believe the world should know.

I am a university student, we are a family of 5, my mom, dad and 2 siblings.

My mom is stay at home mom and my dad had a very good sales job.

Few months back my dad suffered from an extreme illness he had to be admitted to hospital immediately and was no longer able to work.

I am oldest of my siblings and a lot of the responsibility came on my shoulders while was mom for was taking care of my younger brothers, managing household and being at hospital constantly.

Our savings were burning out fast. First thing I did was I moved into a shared living space to cut my expenses.

Eventually I ended up taking 2 part time jobs to support my family while being a full time student.

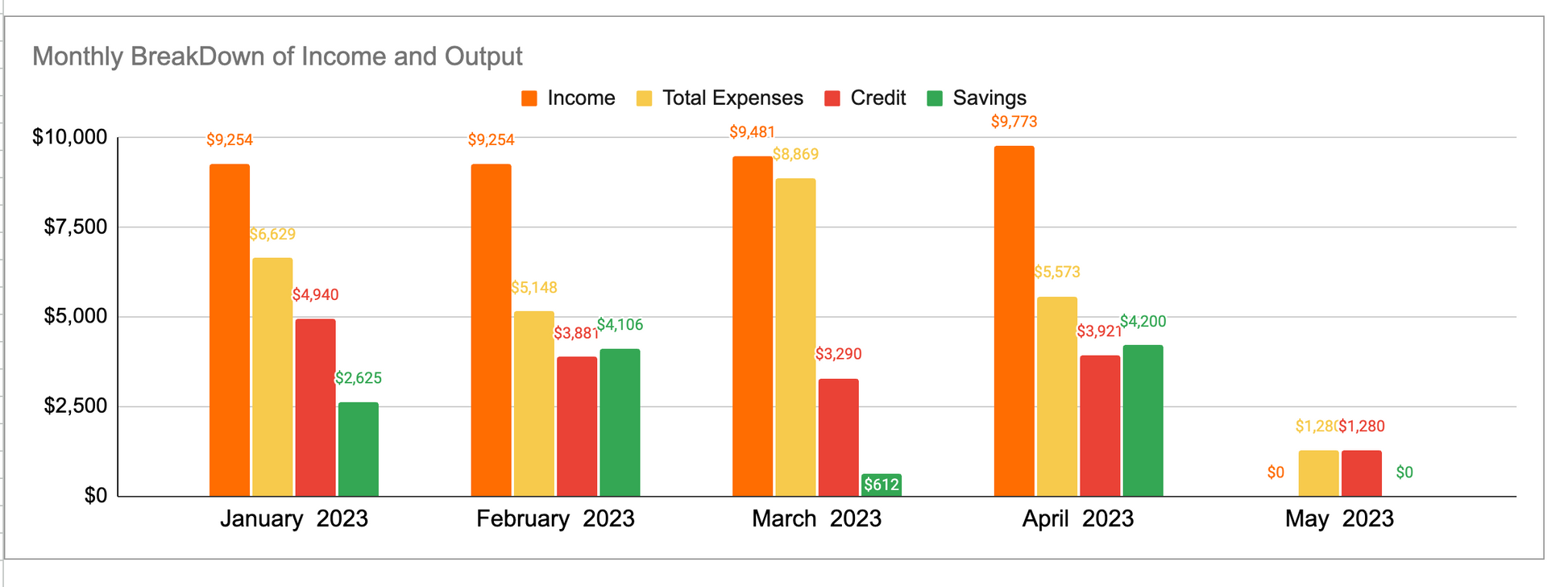

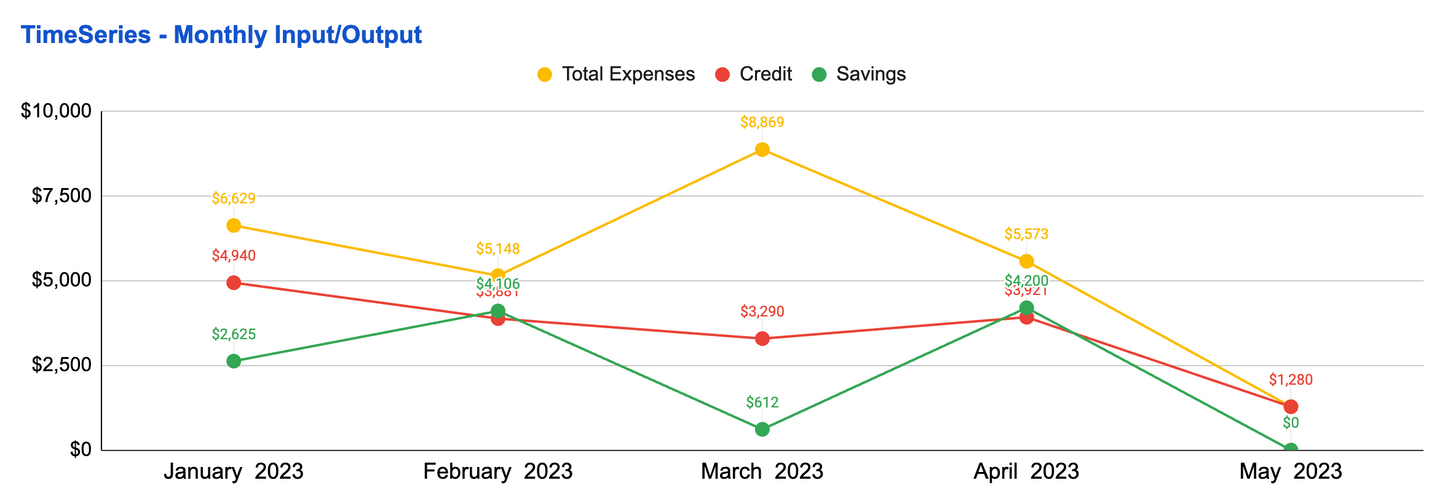

I had no idea of how to manage money. Honestly I was very scared at this time. My dad had always taught me importance of budgeting and he also gifted me this tool on my last Birthday but I never really used it. But I started putting in my expenses into Budget Savy for the first time. It came in handy to understand where I could cut back and where it was necessary to spend.

But that is not the reason why I am writing this today.

It just happened so one day I experienced an issue with the tool and happen to raise it with the Budget Savy team. Literally the next day I was on a call with one of the co-founders. He was extremely professional and kind gentleman and somehow I ended up explaining my whole story to him for about 30 mins. He listened very calmly and patiently, gave me his best wishing and told me how strong I was.

Like what? Nobody does that. And it really mattered to me.

This might be an excellent example of customer service but to me it was about human kindness. First of all nobody gets on a call with a customer because they raised an issue and nobody listens to a customers cry story. I am sure he a super busy person, he didn't need to listen to me but he did it anyway. It left a lasting impact on me, it was one of the few examples of kindness I had seen in my life and that is the reason why I am here today.

I am writing this after about eight months from this incident, my dad is doing much better now, and he is working again at a different job, my mom end up taking a part time work and I am still continuing one of my jobs. Together we are easily able to manage expenses for our family.

Taking up so much responsibility taught me a lot about life and managing finances. I am already planning how I am going to pay back my student loan. I am much more conscious of where I spend my money. I also encourage my friends to do the same. Me and my dad do financial planning for our family together now, be it setting monthly budget, a family vacation or saving for my younger brothers education and I love doing it with him. I am still using this tool and will continue to do so.

P.S. I was able to save about $150 just this last month using this tool. Its not a lot but I have learned that every penny counts.

Emma M.

Most People cannot answer...

What was their most expensive month last year?

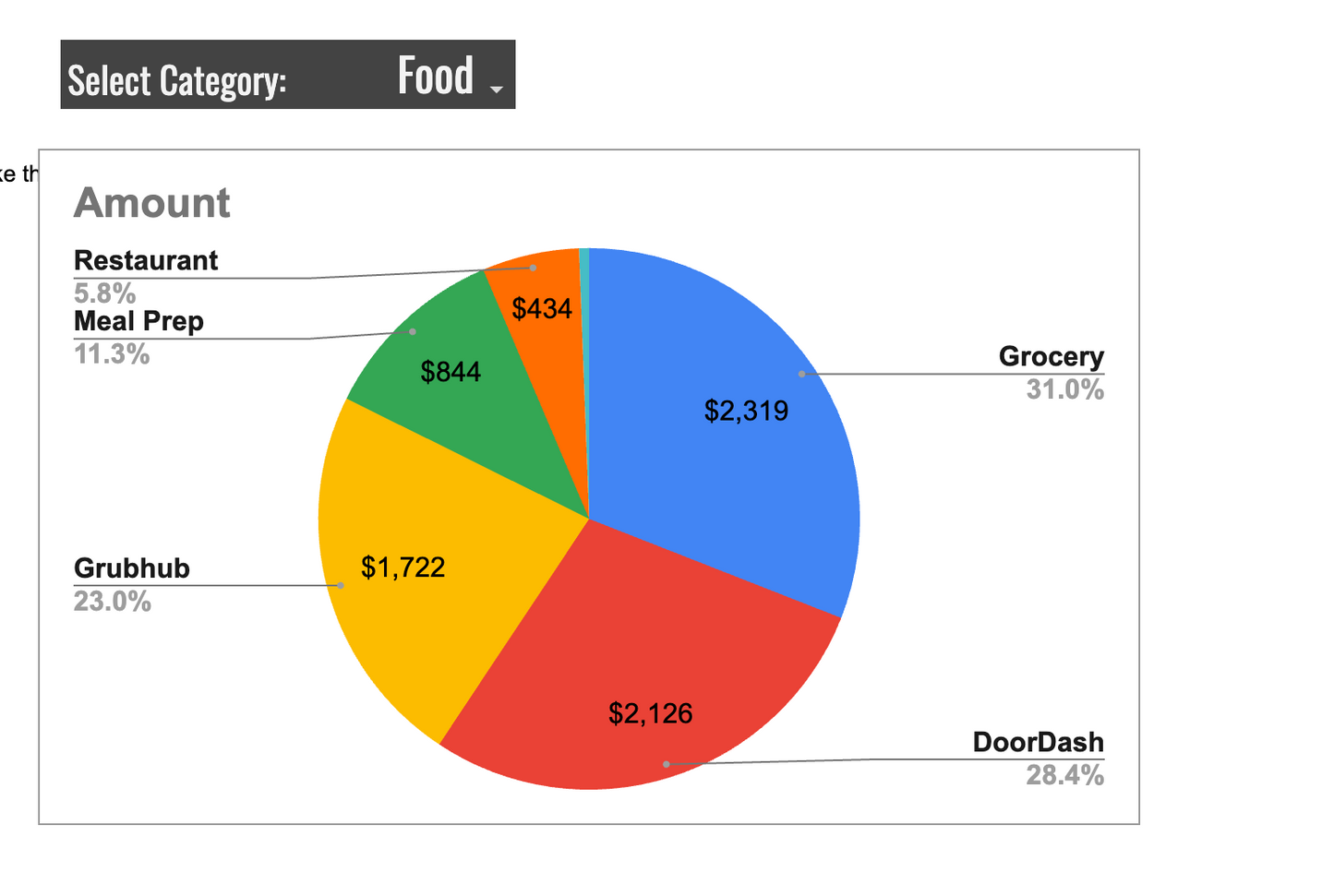

How much they spend on food each month?

How many trips they had to Starbucks?

How many active subscriptions they have?

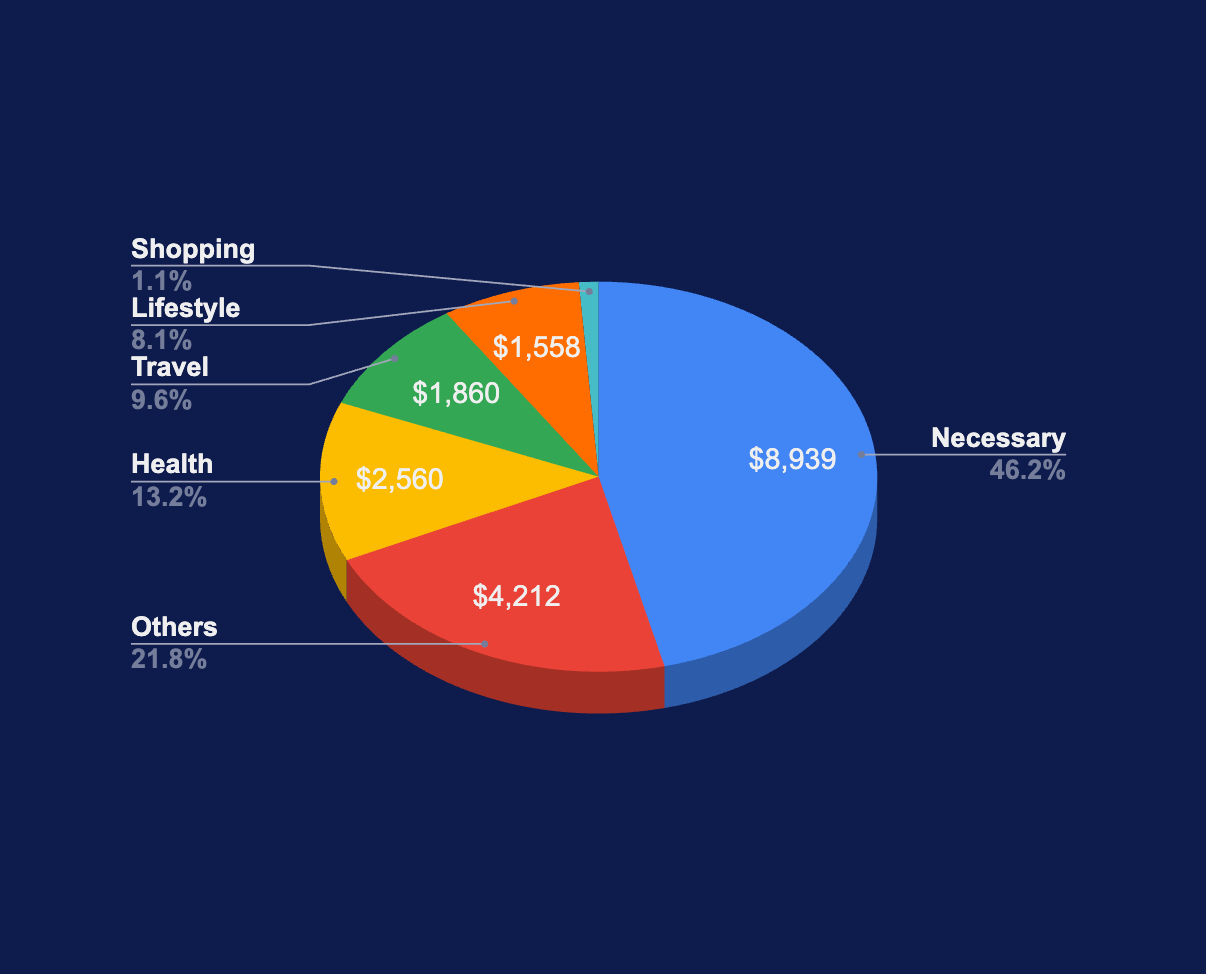

Wouldn't it be cool if you can answer all of these with click of a button, just like Emily did above.

We were very sad to hear this...

63% of Americans are living paycheck to paycheck.

57% of Americans don’t have enough savings to cover a $1000 emergency expense.

One in every 3 of U.S. consumers say they aren’t currently saving any money.

64 million Americans have debt in collections.

But the sad reality is most people don't even know where their money is going.

How can anyone manage and improve what is never measured?

What gets measured, gets managed.

-Peter Ducker

You see, the benefit to tracking is so obvious, we all know it but..

Sometimes life gets in the way. Understanding where our is money is going is such an important aspect of our life but how many of us actually really know it.

Can we all agree that understanding where our money is going, at least gives us peace of mind. Having a clear pictures of our finances, helps!!

What will be the alternative - to not having a clear picture.

A big part of the money equation is earning more income. But you what is the other big part, making better financial decisions. Which is a pretty big part. Here is an interesting fact, 7 out of 10 millionaires did not average $100,000 or more in household income per year - which means two-third of millionaires never had a six-figure household income in their careers.

And one thing we can tell you about higher incomes is that it has nothing to do with better financial decision making. We see it pretty closely and trust us we know a thing or two about finances.

Being able to see how you are spending will help you understand your spending habits. Well guess what this understanding does, it helps you make better financial decisions.

Most people make financial decisions in one of the two ways, either its a genuine need or its an impulse they can't control. Most people live their life on reactive mode, don't be most people.

A good question to ask oneself is what harm it would to do to actually understand your own financial habits and decision making?

91% of our users report, they feel a lot more motivated to make better financial decisions and grow their incomes and savings.

The Good News

We have built the second best thing that can help you with better financial decision making.

You may ask what is the first one, well its YOU!

The Bad News

This tool wont make you warren buffett

See what our users are saying

-

Bruh, WTF!!

I was doing some reorganizing in my house and I was ordering stuff off of amazon, I thought I had spend around $300-$400, so far, when put my data into the tool, I had spent close to $900 already!! Bro I had no idea. Definitely continuing to use this tool.

Jason M. -

Great for tracking Investments

I living in NYC and work as a banker, I came across this tool, I don't use it to track my expenses but I use it to track my investments, I can tell you easiest thing to use. I like two things about it, my data stays in my google account, and I don't have to pay for it every month. Would Recommend.

David A. -

Super Easy

I am stay at home mom and I have always budgeted, was looking for something easy to use, but I didn't want to link something to my credit card or bank account.

I am not technical at all, I had some trouble starting out, but on boarding video really helped me. Once I got the hang of it, I love to use this tool, many a times before making a buying decision I just pull out my phone and see how I have spent in past. Though its much easier to use on my laptop than phone. In my top 3 purchases of this year.

Celine J.

We all want something some of us want to save for that house, some of us want to have that vacation, some of us want to invest, some us want to reduce debt, some of us want to save for kids education, some of us want to start a business, some of us just want to retire comfortably and some of us just want piece of mind.

Possibilities are endless.

But the surest way to NOT arrive is to NOT start.

A Note From Our Founder

There are tons of tracking softwares out there. But Something happened to software in general.

Right now pretty much all of software is a service, its a rental.

Every month you pay for the same thing you paid for last month. And if you stop paying.

You are evicted.

If you add all your subscriptions last year. You should own that thing by now.

We believe people should be able to buy products again. Old school products that you buy once and own forever.

Users need to take back control of their wallets and not pay a company every single month.

We are introducing pay once, own forever model again.

And what sense it would make for a budgeting software if it takes away from your budget every single month.

We don't promise you instant success with Budget Savy. But we do promise that you will find Budget Savy always insightful, always reliable and always useful.

Happy Budgeting!!

Jordan Bellford

Founder & CEO, Budget Savy

Budget Savy

Budget Savy Tools

Share

Track categories

Once set up your data is visible with click of a button.

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.

Caption

Row

Pair text with an image to focus on your chosen product, collection, or blog post. Add details on availability, style, or even provide a review.